Stamp duty in LPF is a tax levied on principal portfolio and interest income arising from portfolio that needs to be collected and handed to the tax body/ authority.

How to calculate stamp duty

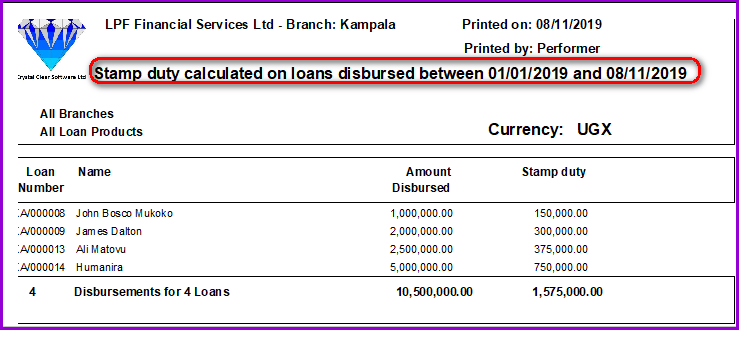

To calculate loan provision you go to Account/Calculate stamp duty and a screen will be displayed as follows:

The system will thus post the Stamp duty transactions as below:

| 1. Stamp duty on principle (Expenses) |

Debit

|

|

| 2. Stamp duty on accrued interest (Expenses) |

Debit

|

|

| 3. Stamp duty liability account |

|

Credit |

|

Debit |

Credit | |

| 1. Stamp duty on principle (Expenses) |

1,575,000

|

|

| 2. Stamp duty on accrued interest (Expenses) |

15,000

|

|

| 3. Stamp duty liability account |

|

1,590,000 |

Click on the Close button to exit.

The Nº 1 Software for Microfinance